bear trap stock chart

Bear trap chart patterns. Alternatively it may cause them to sell off their stock or cryptocurrency assets in order to take profits and prevent losses.

What Is A Bear Trap On The Stock Market Fx Leaders

Access Our Powerful and Intuitive Platforms for Every Kind of Investor.

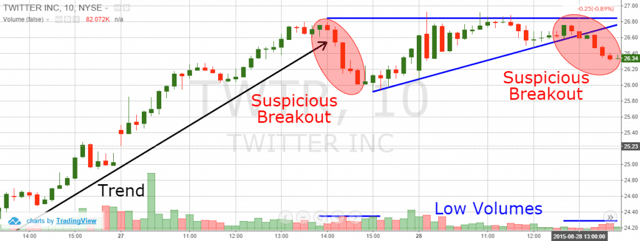

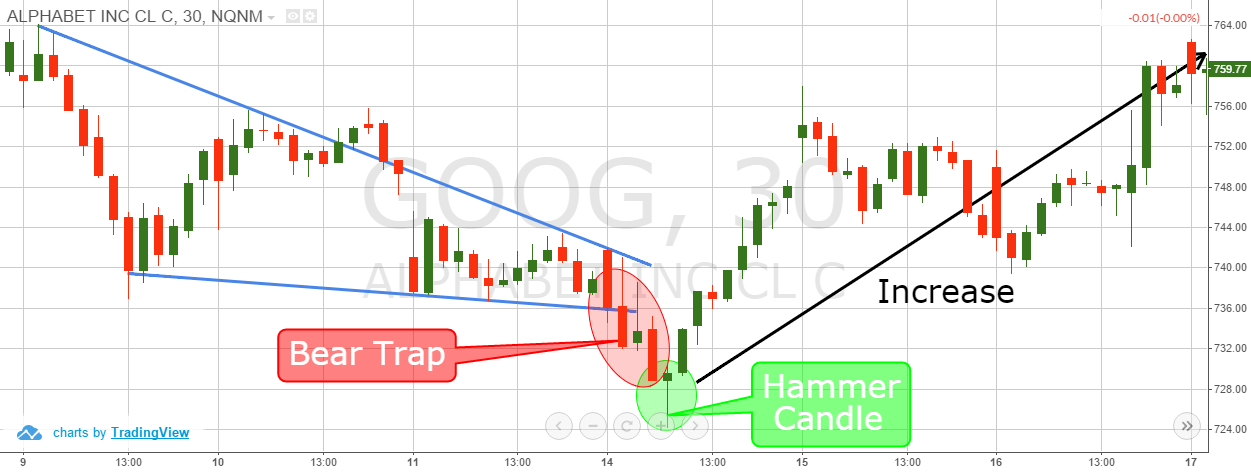

. Bear Trap Chart 3. This can be an area such as a major moving average but it is often a major support level. The basic definition of a bear trap trading is when a bearish chart pattern occurs and falsely signals a reversal of the rising price trend.

As we can see GBPUSD is trading on a bullish trend on the daily chart. For example if you short sold 50 shares of XYZ and they are now trading at 40 you owe your broker 2000 50 x 40. They do this by pushing prices lower to.

Bear trap is a candlestick pattern in which sellers or bears try to push price to go lower in support zones but buyers or bulls take control of price action and cause the price to rise. You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher. What is a Bear Trap.

Ad For investors with 500000 get your free guide and ongoing insights. Bull and Bear Traps provide quick indications of a signal failure but. Below is an example of a bear trap on 76 for the stock Agrium Inc.

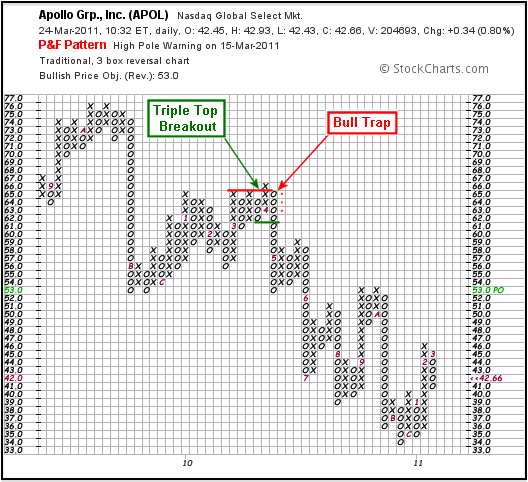

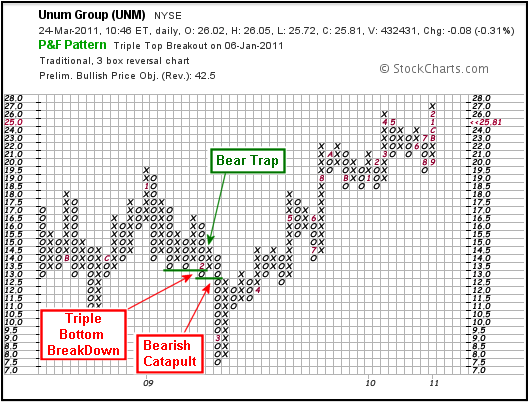

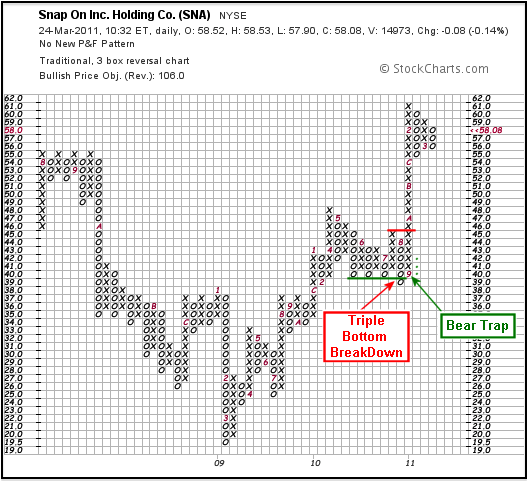

A Bear Trap is a Multiple Bottom Breakdown that reverses after exceeding the prior lows by one box. This is another example of a bear trap stock chart which could be easily recognized with simple price action techniques. What you see is a reversal pattern that has formed on an uptrend.

This causes traders to open short positions with expectations of profiting from the assets price decline. A bear trap is more likely to happen in stocks with large amounts of shares outstanding as short interest and a high short interest ratio. Discover Which Investments Align with Your Financial Goals.

In other words bear trap is a false trading signal which causes traders to open a short position close to support areas in hope for short term profit. It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward. Fibonacci retracements Fibonacci Retracements The Fibonacci retracement is a trading chart pattern that traders use to identify trading levels and.

A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. This pair had formed a support level at around 125 as it retraced lower and then bounced higher to 128 from there. The problem arises when the securitys price starts to rise.

A bear trap is a pattern that can be identified in the charts of investment security. We can see this type of bear trap in the Apple Inc. A bear trap is the opposite of a bull trap.

When a bear trap occurs usually there is a false breakdown of the support level the purpose of which is to drive as many traders as possible into a trap. Below we will consider the popular types of the bear trap pattern. Search from Bear Trap Stock stock photos pictures and royalty-free images from iStock.

Bear Trap Example. The rising demand for a bear trap stock increases the selling pressure affecting the buying chart. Bear traps have a higher probability to happen when a large amount of a stocks float is short a market has an extremely bearish sentiment or sellers simply are exhausted after a long downtrend and the.

Support Level Bear Trap. As the first chart example shows below. A good example of a bear trap can be found on the chart below.

How to Identify a Bear Trap. Emotions Get the Best of Me. First we have a.

To create the bear trap there is a level or area in the market that the trap will be created around. Bear raid - In the context of general equities attempt by investors to move the price of a Stock opportunistically by selling large numbers of Shares short. I Didnt Look to the Left for Support Levels.

Bull and Bear Traps are PF signals that quickly reverse. But it returned from down there and pierced the support level. In particular a Bull Trap is a Multiple Top Breakout that reverses after exceeding the prior highs by one box.

A Bear Trap is a device that is used to capture bears. What is a Bear Trap. Use this guide to understand bear markets and what they mean for your financial goals.

Bull Trap Charting Example. It is caused by a decline in the price of the security which triggers some investors to open short sales. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic. Fear of losing their tiny earnings or even of losing. The stock sold off creating some bear flags and eventually the bear flags failed at support and trapped shorts.

What Happens When You Dont Panic. Real-Life Example of You can Lose Money Panicking. Bear Trap Chart Example.

Strategy 1 Dont Panic. The basic definition of a bear trap trading is when a bearish chart pattern occurs and falsely signals a reversal of the rising price trend. In order to create more demand and get the prices of stocks to move higher institutions need to shake out the amateurnovice traders.

In general a bear trap is a technical trading pattern. Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward. It is a false indication of a reversal from an uptrend into a downtrend.

This imbalance caused due to increased demand and lowered supply shows a negative market trend. Ad Financial Security is Attainable. Below is an example of a bear trap on 76 for the stock Agrium Inc.

The investors pocket the difference between the initial price and the new lower price after this maneuver. In the above example if you shorted XYZ and the stock is currently at 50 you would need at least 15 in your account for each stock you. Find high-quality stock photos that you wont find anywhere else.

If XYZ rose to 50 you would owe your broker 2500 50 x 50. Find a Dedicated Financial Advisor Now. Below is an example of a bear trap on 76 for the stock Agrium Inc.

Pattern 1 - Collapse in the gap. Looking at the weekly and daily chart we believe the.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market Fx Leaders

P F Bull Bear Traps Chartschool

3 Bear Trap Chart Patterns You Don T Know

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Stock Trading Definition Example How It Works

P F Bull Bear Traps Chartschool

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap Seeking Alpha

How To Avoid A Bear Trap When Trading Crypto Bybit Learn

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

The Great Bear Trap Bull Trap Seeking Alpha

The Bear Trap Everything You Ve Ever Wanted To Know About It

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim